Joining the board of a company trading on the world’s first regulated stock exchange for real estate | IPSX CEO, Roger Clarke

Roger Clarke

Group Chief Executive Officer of IPSX

Roger Clarke has spent 30 years working in European capital markets including investment banking roles at NM Rothschild, Dresdner Kleinwort Wasserstein, JP Morgan Cazenove and Stifel Nicolaus, as well as undertaking a secondment to the UK Takeover Panel.

He has also been Head of UK Capital Markets for ING Real Estate, and more recently he was Head of Corporate Finance at M7 Real Estate where he set up and ran the alternative lending platform, Tunstall Real Estate.

He qualified as a Chartered Accountant with Arthur Andersen.

Why do you think this is an exciting time to join the Board of a company seeking admission to trading on IPSX?

"IPSX is the world’s first regulated securities exchange for commercial real estate. We are an FCA-regulated Recognised Investment Exchange whose aim is to democratize access to the commercial real estate market for retail and small institutional investors, thus creating an alternative capital markets solution that enables direct fractional investment into commercial property. In doing so, we want to offer investors greater transparency, liquidity, flexibility to trade and access to yield information on the assets quoted on the exchange. For the first time, the growing tide of investors seeking out property has direct and cost-effective access to real estate.

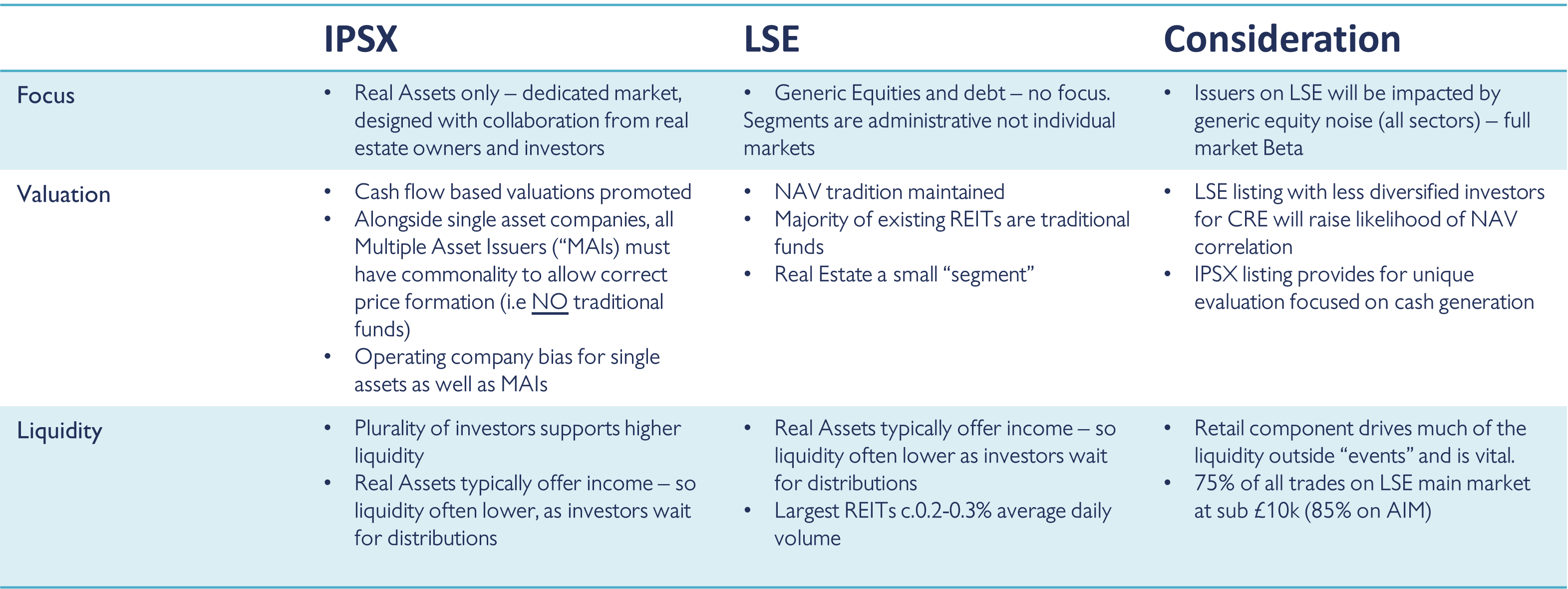

By concentrating solely on property through a dedicated exchange, IPSX also ensures that an investor’s assets are protected from market movements that have nothing to do with the underlying value of the real estate asset.

Time and again, we see listed property companies’ share prices rise or fall simply from their inclusion in, or correlation with, the FTSE 100 or 250 indices. Their values are skewed by forces unrelated to the performance of the property assets they hold. Investing through IPSX means access to assets valued solely on their own merit."

So why now?

"IPSX launched onto the scene last year with its maiden admission, the emblematic Mailbox building in Birmingham, which has just celebrated its first year of trading, accomplishing something that the industry had tried to do for decades, fundamentally transforming the way investors can access institutional grade assets, unlocking access to a far greater universe of capital, and providing much needed choice in the way that property is owned and crucially, traded. Ever since, IPSX has been gaining traction as a compelling marketplace for trading shares in single institutional grade commercial real estate assets with commonality. The Mailbox was shortly followed by the M7 E-Warehouse REIT in December of last year, and the momentum has continued to build. The number of listings is set to triple across the next 3 months, with a potential pipeline of between 10-12 admissions hitting the exchange by the end of 2022. The admissions are widely varied, across sectors, locations, and size. The growing pipeline of potential new IPOs currently comprises in excess of £5 billion of gross asset value."

What do typical investors and shareholders look like?

"All types of investors have the opportunity to invest in securities admitted to trading on IPSX, from the man in the street to a large institution. Any investor owning shares on the London Stock Exchange or other broad based stock markets will be able to own shares in securities admitted to trading on IPSX. We also hope to appeal to a lot of investors who have traditionally been less active in conventional stock markets. Investors like family offices, private banks, fixed income investors and direct real estate investors are all attracted to IPSX because of the low correlation to other markets and the lack of volatile share prices that this results in. These investors rarely buy real estate companies which are traded on the London Stock Exchange but are already active on IPSX. "

What experience and skills would a NED need to join a company listed on the exchange?

"IPSX companies are going to be, predominantly, UK plc’s just as on other exchanges. And in the same way, they will be subject to the UK Companies Act, securities laws, and the Takeover Code. The experience needed, and the role itself, is therefore very similar to that for an investment trust which is admitted to trading on the London Stock Exchange."

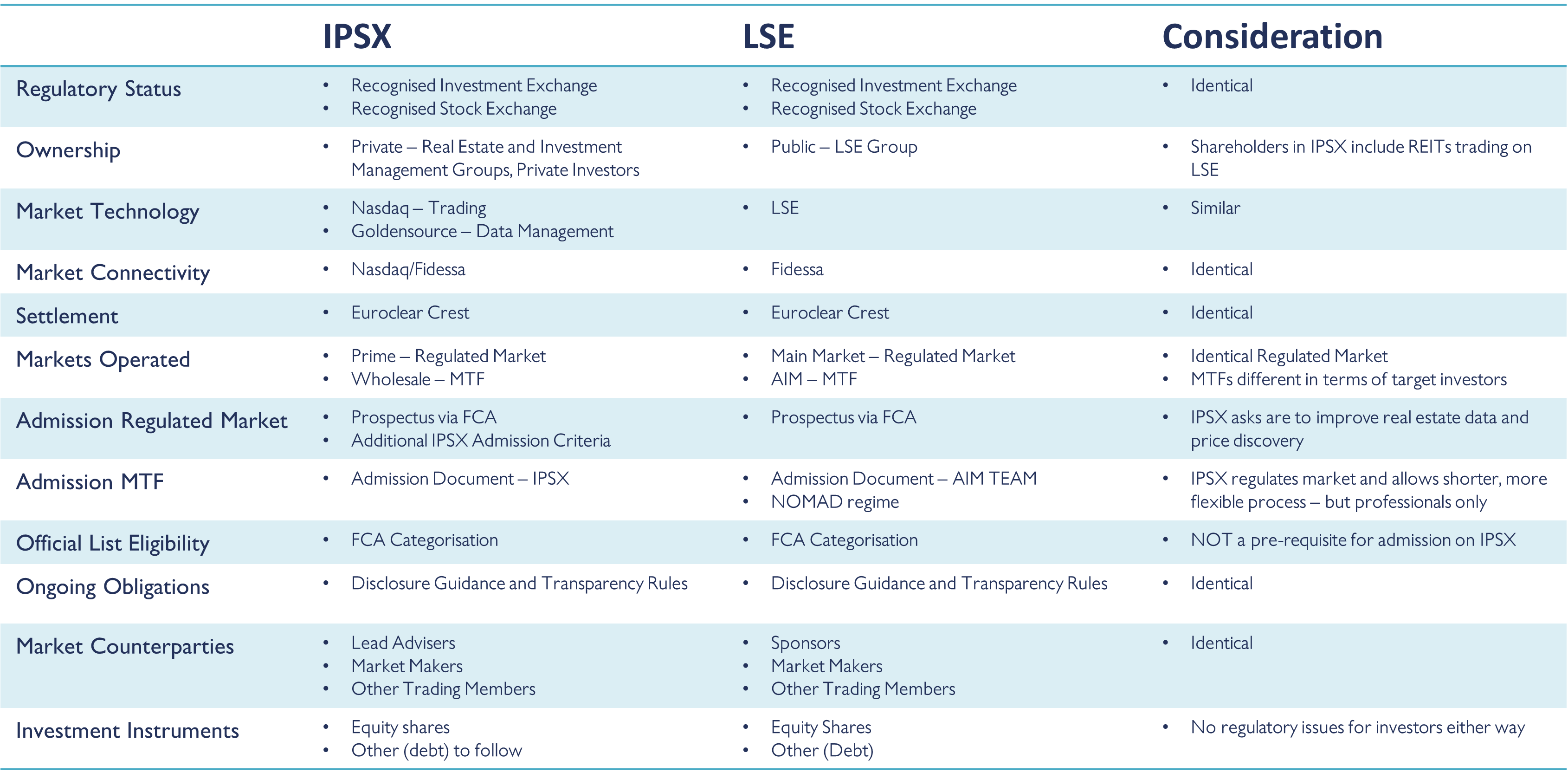

Regulatory implications between IPSX and the London Stock Exchange are different. What does a NED need to know?

Our markets:

IPSX PRIME

- IPSX Prime is our principal Regulated Market available to both retail and institutional investors

- Stabilised income-producing assets

- Liquidity provided by market makers

Requirements:

- Minimum asset value of £50m

- Minimum of 25% free float

- Issue an FCA-approved prospectus

IPSX WHOLESALE

- IPSX Wholesale has the same broad features as Prime but is a multilateral trading facility

(MTF), designed to accommodate more complex issuers in terms of ownership structures,

legal arrangements or tenancy profiles. Companies admitted to trading on IPSX Wholesale

are not subject to the same minimum free float rules as on IPSX Prime and must issue

admission documents if they are not required to produce a prospectus. - Exclusively for institutional investors or designated professional investors

- Two market models: Market Maker or Broker-Driven

Requirements:

- Must meet the Exchange’s admission standards

- No prescribed minimum free float

- Maximum of 80% leverage

- Admission Document produced in accordance with IPSX rules