AIM ESG Performance: Technology

Nurole’s AIM ESG series, created with Addidat, provides information about AIM companies’ ESG requirements and performance, along with practical suggestions about what they can do to improve. This article focuses on governance performance of companies operating in the technology sector, specifically addressing two key issues: how firms govern ESG at the board level, and whether they should produce a separate ESG or sustainability report in addition to an Annual Report.

Introduction

As with all three streams of ESG, there is no universal consensus on the meaning or definition of governance. It can include standalone factors: board composition, diversity, remuneration, stakeholder alignment, risk management, audit, tax and accounting. And it can also refer to the way in which the 20+ ESG topics are governed themselves.

It is this second definition that we focus on in this article.

When thinking about ESG governance, firms face several recurring challenges. Where in our organisation should ESG be governed, and by whom? How can we best pull together the multiple streams of ESG from across the organisation? How do we integrate ESG into our business strategy? And how do we best report our strategy and achievements to our many interested stakeholders, including investors, clients and employees?

These challenges typically manifest in two immediate questions:

- Should we set up a board level ESG committee? (ESG governance)

- Should we produce a separate ESG or sustainability report in addition to the annual report? (ESG reporting)

The addition of a board level committee or the development of a separate ESG report requires significant effort. However, organisations that coordinate and communicate their ESG activities effectively can reap considerable benefits. As with most things in ESG - there is no one right answer, as we explain below.

Part one: ESG Governance

Many boards are struggling to identify and commit the resources necessary to govern ESG properly. In the 2022 BCG-Insead Board ESG pulse check, 40% of directors cited their own inability to execute ESG policies as one of the key factors holding back progress. Where such knowledge does exist, it is often unco-ordinated, dispersed unevenly across the organisation in pockets of teams or functions.

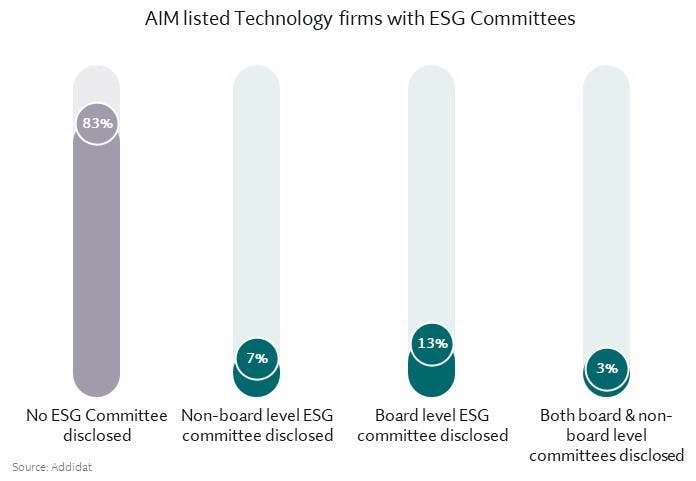

Nonetheless, a minority of AIM quoted firms already have ESG governing bodies.

How do technology firms compare to other sectors?

In terms of the number of firms with board level ESG governing bodies in place, technology organisations rank third on the AIM index, beneath basic materials and energy. The position of energy and basic materials firms isn’t surprising given longstanding pressures on these industries to improve their ESG performance, as discussed in our earlier article.

The relative progress of technology is harder to explain. It may be that firms are looking to capitalise on investors, who may see technology stock as more aligned with their own ESG mandates, given the relatively low emissions in the sector. Or it may be a point in time and this is indicative of where the rest of the market is heading.

It is also unusual that there are more technology firms with board level ESG committees than sub-board committees. Generally across the AIM market, we see the reverse, with higher levels of sub-board committees. The latter, more common trend might be explained on the grounds that organisations prefer to seed ESG committees below board level and subsequently elevate them once the business reaches sufficient maturity and understanding. It is unclear why technology is an outlier.

5 key considerations when establishing an ESG committee

ESG committees can be a clear sign to stakeholders that an organisation is committed to ESG. They can enable a co-ordinated - and ultimately more valuable - approach to managing, overseeing, integrating and reporting. And as such, they can ensure a company realises the full value of its ESG positioning.

However, we often see firms run into problems when creating ESG committees because they do not spend enough time finding the right people or establishing a clear enough remit.

Here are 5 key considerations, which will give your firm the best chance of success:

1. Ask whether a board level ESG committee is really the best way of achieving good governance.

- Consider the overall corporate governance structure of your organisation, alongside the actual and potential ESG pressures you face.

2. Set the committee Terms of Reference upfront.

- What does success look like?

- What is the scope of its responsibilities? (Scope will depend largely on your company’s purpose. It will vary considerably by sector. Technology firms, for example, are often more interested in D&I and cyber. Whereas basic materials firms tend to focus on environmental management and community engagement.)

- How does it report into the wider organisation and board?

3. Make sure your ESG committee members have the necessary experience and are committed to understanding the evolving character of ESG.

- If we don’t have credible experience within the organisation, how will we source it?

- Ensure members receive ongoing ESG training. Regular seminars with lawyers, consultants, brokers etc. can be an effective way of doing this.

- Benchmark the company’s holistic ESG position against its peers on a regular basis to understand competitive advantages and avoid the risk of lagging behind peers.

4. Update the organisational structure to allow the whole organisation to consider ESG, rather than confining it to the specific sub-committee.

- To avoid the risk of individuals not taking responsibility for ESG, relevant considerations should feed into the board and leadership team at the least. It is typically already a core topic of audit and risk committees, and it is increasingly on remuneration committee agendas too.

5. Align and communicate the ESG committee’s strategy with investors and key clients.

- Companies that can help clients and investors meet their own ESG needs will have a competitive advantage.

- There needs to be a regular feedback loop between the committee and its key stakeholders. The committee should bear stakeholders in mind when setting ESG strategy and continue to keep them informed as they realise it.

Is an ESG committee the best solution?

ESG committees are just one means of ensuring good governance. But the particular means matter less than the ends. It’s more important that boards take responsibility for the desired outcomes rather than investing in committees as a tick-box exercise. With that in mind, it is important for the board to:

- Assume responsibility for managing ESG risks and opportunities

- Have effective oversight of ESG activity and hold management to account.

- Track ESG progress and have a grasp on material and pending tasks

- Demonstrate the right level of education and experience to the rest of the company.

Part two: ESG reporting

Historically, there has been a consensus that companies should produce a separate ESG or sustainability report if they want to showcase their ESG achievements and establish their credentials as an ESG leader. In line with this, companies that report against the Global Reporting Initiative (GRI) typically produce an annual sustainability or ESG report that is fully indexed to the GRI framework.

However, a new EU ESG regulation, the Corporate Sustainability Reporting Directive (CSRD), requires impacted firms to report disclosures in their audited, machine-readable Annual Report. Because the EU is a global regulatory leader in this space, it may bring about a culture change, which would shift the norm away from a separate ESG report to one included as part of the Annual Report.

Separate vs. integrated reporting

Once an ESG strategy has been well-defined and a firm is making progress, there are clear benefits to publishing a separate report. The big win is reducing pressure on the Annual Report, which requires increasing resources year-on-year, by publishing the ESG report at a later date.

Moreover, a separate report allows companies to trial run data outside of an audited report before they are required to expose it to the auditors’ scrutiny as part of the Annual Report.

On the other hand, companies need to be careful not to segment their ESG strategy because stakeholders will expect it to be integrated into their overarching business strategy. Moreover, the overall effort to produce a standalone report in addition to the Annual Report will likely increase effort and cost in the round.

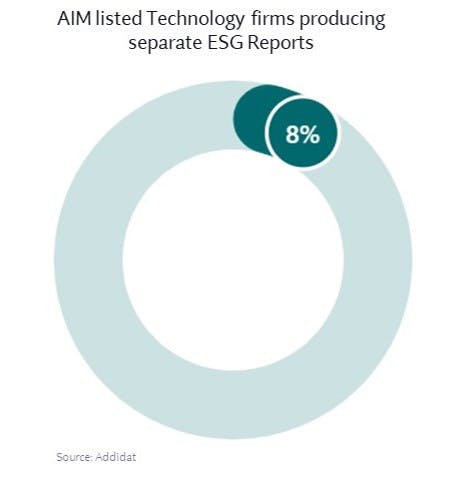

Addidat’s data shows that 8% of AIM Technology firms produce separate sustainability reports today.

5 key considerations when thinking about whether to create a separate ESG report

1. Clarify exactly why you want to create a separate report.

- What pressures are you responding to?

- Is there a lower effort alternative to meet those pressures or needs? Would a website page meet the need to showcase the unaudited data, for example, that can be referenced in the Annual Report?

- What is your firm's ESG vision? Is that vision better reflected by an integrated or separate report?

2. Understand what your peers are doing.

- How do you want to position yourself against or alongside them?

3. Ascertain whether you fall within the CSRD regulatory framework.

- If you do, you will have to produce an integrated report anyway. (see Addidat’s explainer summary from last year).

4. Weight the total time and effort cost of the separate report against the additional pressure of integrating in the Annual Report.

5. Understand whether the data cut will be the same.

- If it is the same, there will probably be pressure to produce the ESG report in quick succession to the Annual Report, which may impact the benefit of reducing the Annual Report time pressure.

- If it isn’t the same, how will you handle the potential complexities in differing data in the marketplace?

A separate report might be the answer, even if for an interim 3-5 year period. This will allow you to incubate ESG as you develop your strategy until you are confident that you can embed it into the audited Annual Report.

As an alternative, a small number of AIM firms are ticking both boxes by saving down their integrated ESG reports as separate documents, i.e. their ESG report forms a distinct section of their Annual Report, and they can publish this as its own stand alone document in line with the Annual Report. This may become the preferred method in due course.

ESG communications

The quality and clarity of communications are arguably more important than their form. A recent QCA report on investor attitudes to ESG highlighted widespread dissatisfaction with the standard of reporting from small cap firms. We also see this in ESG reporting, integrated or separate.

Often, there is too much use of fuzzy marketing language and insufficient clarity around the meaning of ESG terminology. “Carbon Neutral”, for instance, means different things to different people, and hence it should be properly defined.

Less tends to be more, and firms should focus on quantitative data where possible. They should try to demonstrate what they are doing in the simplest terms: show how the board is taking responsibility; articulate the firm’s targets; suggest how they are going to be achieved, and indicate progress against those targets.

Additional Resources:

GRI: Global Reporting Initiative is the global leader in impact reporting.

Quoted Companies Alliance (QCA) ESG reports: Investor Survey May 2023 and Practical Guide to ESG from 2022.

BoardClic has developed a Board-Executive digital alignment software, and includes an ESG alignment tool

Corporate Governance Institute has an ESG for board certification and runs many events covering good governance.

Nurole runs AIM Masterminds Groups, confidential environments in which AIM board peers can learn, benchmark and network with each other.

Addidat publishes an AIM-focused monthly ESG newsletter, highlighting key regulatory updates and trends, as well as links to articles like this one. Subscribe via the link to receive it straight to your inbox monthly.

This article was created with Addidat

Addidat is the leading provider of ESG benchmark data for the London Stock Exchange AIM market, covering all industry sectors. Our accurate and comprehensive ESG dataset enables our clients to understand what their peers and competitors are achieving in ESG, how they compare and what they need to do to enhance or maintain their positioning.

Addidat’s benchmarking data delivers actionable findings, laying the foundations for successful ESG strategies and providing confidence that investment is being targeted in the areas that matter most to investors, clients, employees and regulators.

www.addidat.com │ linkedin.com/company/addidat-ltd │[email protected]