AIM ESG Performance: Energy & Basic Materials

Nurole’s AIM ESG series, created with Addidat, provides information about AIM companies’ ESG requirements and performance, along with practical suggestions about what they can do to improve. This article focuses on key aspects of the environmental performance of companies operating in the Energy & Basic Materials sectors.

Introduction

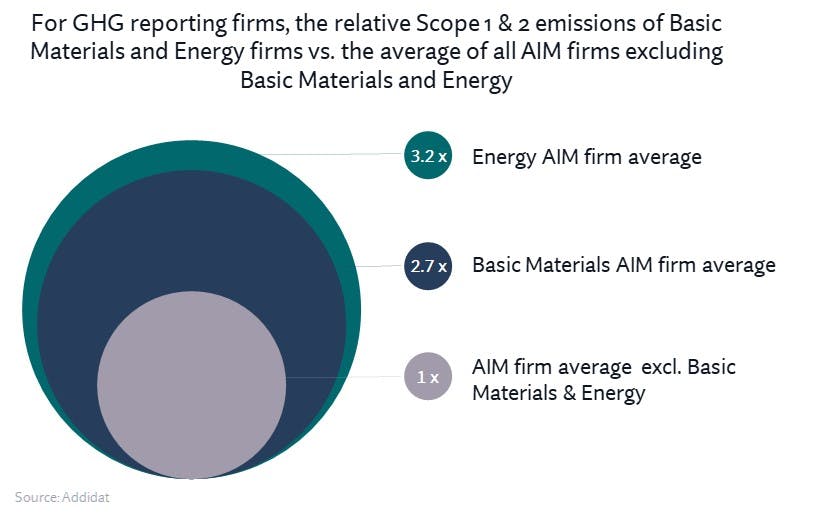

Energy and basic materials companies are two of the main contributors to rising global warming and greenhouse gas emissions (4-7% Mining and 42% Gas & Oil, McKinsey 2020). In an AIM context, these two industries emit around 3 fold more Scope 1 and 2 greenhouse gases than the average of firms operating in all other sectors.

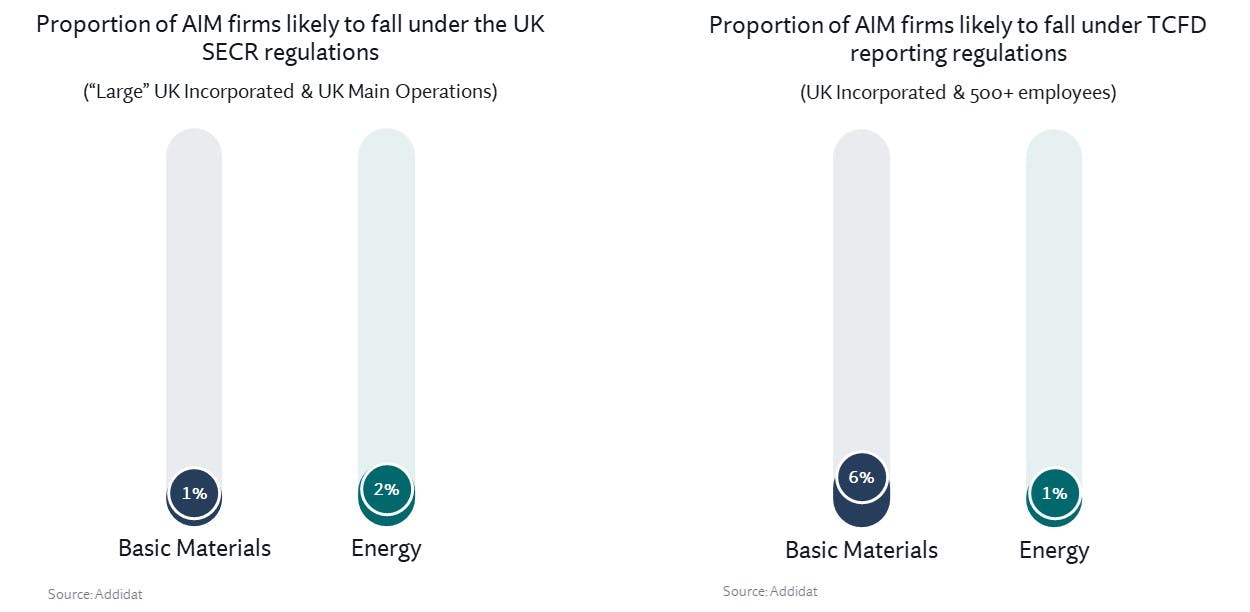

Whilst these sectors are subject to a large amount of international climate regulation, the vast majority of AIM companies currently fall beyond the scope of both the Energy and Carbon Report Regulations (SECR) and Companies Climate-Related Financial Disclosure Regulations (TCFD), the two main UK regulations respectively requiring greenhouse gas (GHG) emission reporting and climate risk financial impact analysis.

Notwithstanding the current lack of regulation, understanding and managing environmental performance is critical because of the pressure that clients, investors and employees are exerting on the firms they do business with.

Together, these groups now represent a myriad of indirect pressures: scope 3 GHG emission reporting (on a company’s supply chain); responsible investment trends and regulation; government contract conditions… the list could go on (see our article on what the AIM basic materials and energy company standards are and where they come from).

Therefore, it is critical for AIM basic materials and energy company boards to be able to contextualise their company’s environmental performance, understand the resulting risks and opportunities, and ascertain what they can do in response.

How are AIM basic materials and energy companies performing?

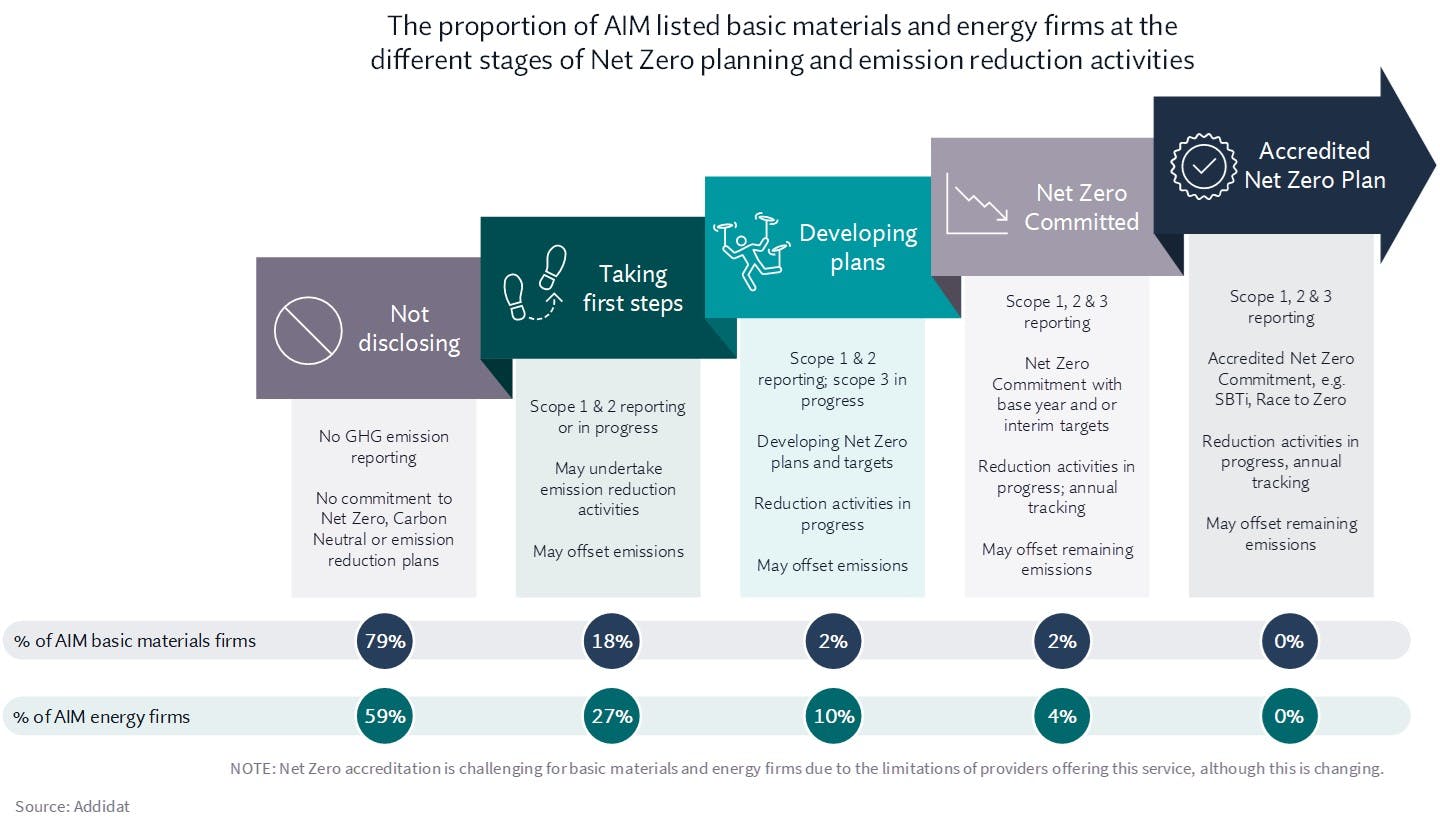

Only a very small number of AIM listed energy and basic materials firms are either reporting on their GHG emissions, taking meaningful steps to define and reach Net Zero targets, or assessing the commercial risk of climate change.

GHG Emissions Reporting and Net Zero Maturity

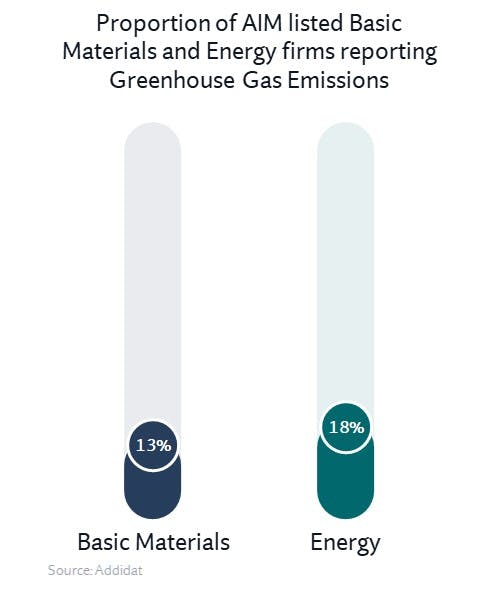

To develop a credible Net Zero or Carbon Neutral plan, the first step is to calculate a company’s GHG emissions. Although many more firms are reporting emissions than required under the SECR regulations, both basic materials and energy firms are well below the all AIM participant average reporting rate of 32%.

There is still a long way to go, therefore, if companies want to meet the Paris Agreement goals (limiting global warming well below 2°C). The vast majority of AIM listed basic materials and energy firms are neither disclosing any carbon reduction activities nor developing plans to reduce or offset their GHG emissions.

Financial Climate Risk Reporting

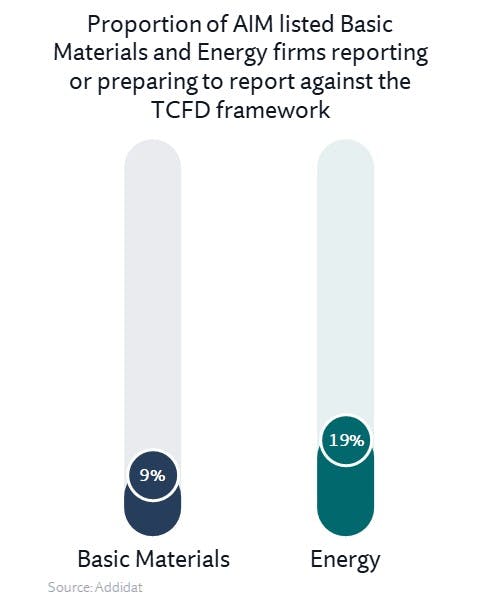

As with SECR, even though the majority of basic materials and energy firms currently fall outside the scope of the regulation and are not required to report against the TCFD framework, there are several firms that are already reporting (or preparing to report) voluntarily in order to better understand and mitigate the impact of climate risk on their firms.

What can firms do to improve their performance?

1. Get ahead of evolving regulations

It is very likely that mandatory TCFD reporting will expand to more firms within the next few years. The required scenario analysis can take time, and companies may want to dry run the data for a year or two before reporting formally in their annual report.

Additionally, as pressure to achieve the Paris Agreement goals and climate change action continues to evolve, it is anticipated that GHG reporting regulations will tighten (although investor and client demands will probably have an earlier impact for AIM firms).

Scope 3 emission reporting can be particularly challenging as it requires engagement with the supply chain and may take experimentation before confidence is achieved in the reportable data.

2. Undertake adequate climate risk analysis

Both energy and basic material companies will continue to be disrupted by climate change. Boards need to understand, monitor and manage the risks (energy and commodity transition, physical impacts on operating sites, demand changes etc.) as well as the opportunities (the green economy, competitive advantage, etc).

As a minimum, boards should understand the evolving supply-chain and investor data needs, as well as any minimum expectations with regard to GHG emission reporting, Net Zero activity and climate change risk management.

3. Contextualise your ESG performance to set bold targets at board level

Get a better understanding of where you sit against your peers and competitors, in terms of their progress and focus areas, to ascertain your unique priority areas and realistic board metrics and targets.

4. Identify clear steps to reduce GHG emissions:

Achieving Net Zero is a complex, long-term challenge and companies should start thinking, planning and acting on GHG emission reduction if they are not already.

It is important that plans and targets are robust, science-based and can be tracked effectively to mitigate the reputational damage risk of greenwashing or being unable to show meaningful progress towards defined targets.

There will be quick wins as well as long term strategic actions firms can take to help achieve Net Zero by 2050. Areas of focus should include:

- Creating operational efficiencies

- Improving maintenance procedures

- Increasing operational monitoring

- Transitioning to renewable energy sources

- Offsetting emissions

Further resources

- GHG Protocol offers tool kits and details on standards for reporting accurate GHG emissions.

- SECR UK Government Environmental Reporting Guidelines

- TCFD Task Force for Climate-related Financial Disclosures

- Chapter Zero a NED community to support crucial climate change discussion in the boardroom.

- Science Based Targets can help with developing accredited net zero and interim targets. It offers a useful consideration of fossil fuel companies on a case by case basis, and it’s developing new methodologies for companies in both these industries.

This article was created with Addidat

Addidat is the leading provider of ESG benchmark data for the London Stock Exchange AIM market, covering all industry sectors. Our accurate and comprehensive ESG dataset enables our clients to understand what their peers and competitors are achieving in ESG, how they compare and what they need to do to enhance or maintain their positioning.

Addidat’s benchmarking data delivers actionable findings, laying the foundations for successful ESG strategies and providing confidence that investment is being targeted in the areas that matter most to investors, clients, employees and regulators.

www.addidat.com │ linkedin.com/company/addidat-ltd │ [email protected]